Page 27 - P6 Slide Taxation - Lecture Day 6 - Groups, Interest And Practice Questions

P. 27

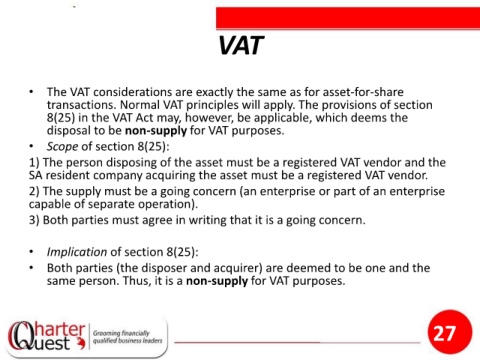

VAT

• The VAT considerations are exactly the same as for asset-for-share

transactions. Normal VAT principles will apply. The provisions of section

8(25) in the VAT Act may, however, be applicable, which deems the

disposal to be non-supply for VAT purposes.

• Scope of section 8(25):

1) The person disposing of the asset must be a registered VAT vendor and the

SA resident company acquiring the asset must be a registered VAT vendor.

2) The supply must be a going concern (an enterprise or part of an enterprise

capable of separate operation).

3) Both parties must agree in writing that it is a going concern.

• Implication of section 8(25):

• Both parties (the disposer and acquirer) are deemed to be one and the

same person. Thus, it is a non-supply for VAT purposes.

27