Page 44 - P6 Slide Taxation - Lecture Day 6 - Groups, Interest And Practice Questions

P. 44

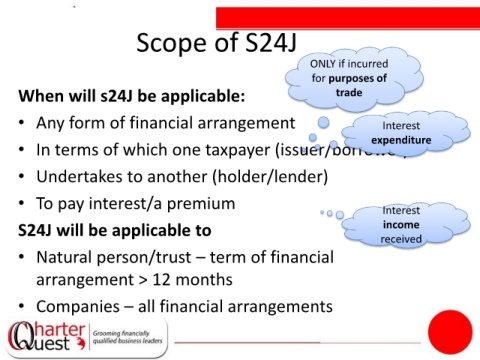

Scope of S24J

ONLY if incurred

for purposes of

When will s24J be applicable: trade

• Any form of financial arrangement Interest

expenditure

• In terms of which one taxpayer (issuer/borrower)

• Undertakes to another (holder/lender)

• To pay interest/a premium Interest

S24J will be applicable to income

received

• Natural person/trust – term of financial

arrangement > 12 months

• Companies – all financial arrangements