Page 5 - P6 Slide Taxation - Lecture Day 6 - Groups, Interest And Practice Questions

P. 5

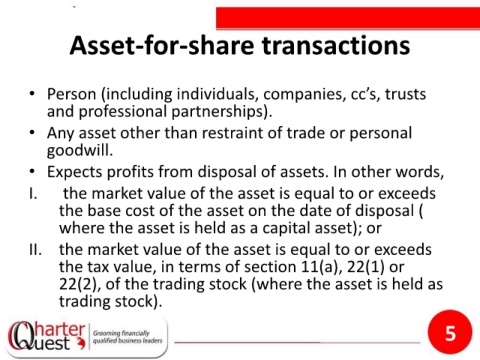

Asset-for-share transactions

• Person (including individuals, companies, cc’s, trusts

and professional partnerships).

• Any asset other than restraint of trade or personal

goodwill.

• Expects profits from disposal of assets. In other words,

I. the market value of the asset is equal to or exceeds

the base cost of the asset on the date of disposal (

where the asset is held as a capital asset); or

II. the market value of the asset is equal to or exceeds

the tax value, in terms of section 11(a), 22(1) or

22(2), of the trading stock (where the asset is held as

trading stock).

5