Page 51 - P6 Slide Taxation - Lecture Day 6 - Groups, Interest And Practice Questions

P. 51

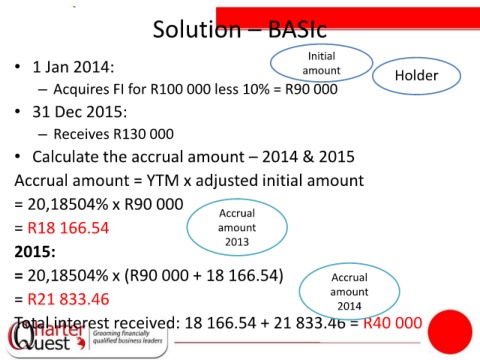

Solution – BASIc

Initial

• 1 Jan 2014: amount Holder

– Acquires FI for R100 000 less 10% = R90 000

• 31 Dec 2015:

– Receives R130 000

• Calculate the accrual amount – 2014 & 2015

Accrual amount = YTM x adjusted initial amount

= 20,18504% x R90 000

Accrual

= R18 166.54 amount

2013

2015:

= 20,18504% x (R90 000 + 18 166.54) Accrual

amount

= R21 833.46

2014

Total interest received: 18 166.54 + 21 833.46 = R40 000