Page 60 - P6 Slide Taxation - Lecture Day 6 - Groups, Interest And Practice Questions

P. 60

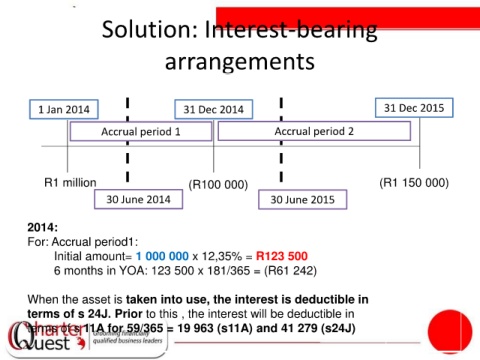

Solution: Interest-bearing

arrangements

1 Jan 2014 31 Dec 2014 31 Dec 2015

Accrual period 1 Accrual period 2

R1 million (R100 000) (R1 150 000)

30 June 2014 30 June 2015

2014:

For: Accrual period1:

Initial amount= 1 000 000 x 12,35% = R123 500

6 months in YOA: 123 500 x 181/365 = (R61 242)

When the asset is taken into use, the interest is deductible in

terms of s 24J. Prior to this , the interest will be deductible in

terms of s 11A for 59/365 = 19 963 (s11A) and 41 279 (s24J)