Page 275 - F1 Integrated Workbook STUDENT 2018

P. 275

IAAS 21 Thhe effectss of channges in foreign exxchangee rates

3.1 Subsequennt measureement – ssettled trannsactions

When ccash settleement occuurs, for exaample paymment by a receivablee, the settleed

amount should bee translated using thee spot exchange ratee on the seettlement ddate.

If this aamount difffers from thhat recordeed when thhe transacttion occurrred, there wwill be

an exchhange diffeerence which is takenn to the staatement off profit or looss in the pperiod

in which it arises..

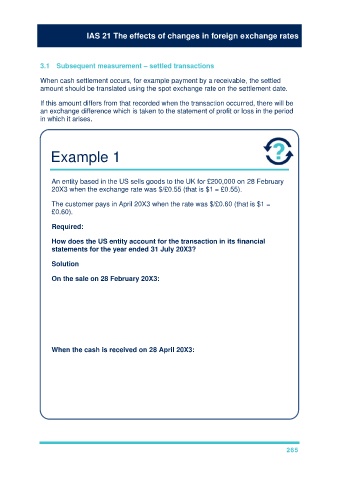

Exxampple 1

An entity baseed in the UUS sells gooods to thee UK for £200,000 on 28 Februaary

20XX3 when thhe exchangge rate was $/£0.55 (that is $1 = £0.55).

Thee customerr pays in AApril 20X3 wwhen the rrate was $//£0.60 (thaat is $1 =

£0.60).

Reqquired:

Howw does thhe US entitty accounnt for the transactionn in its finnancial

staatements ffor the yeaar ended 331 July 20XX3?

Sollution

On the sale oon 28 February 20XX3:

Traanslate the sale at thee spot ratee prevailingg on the traansaction ddate.

£2000,000/0.55 = $363,6636

$

Dr Receivablees 363,636

Cr SSales 363,636

Whhen the cash is receeived on 28 April 20X3:

$ vaalue of cassh receivedd = £200,0000/0.60 = $333,333

Losss on transsaction = $363,636 – $333,333 = $30,3033

$

Dr Bank 333,333

Cr Receivablees 363,636

Dr P/L (loss) 30,303

265