Page 360 - F1 Integrated Workbook STUDENT 2018

P. 360

Chapter 21

Accounting for associates

Associates are not consolidated in the way that subsidiaries are because the parent

does not have control. Instead they are equity accounted within the consolidated

financial statements.

2.1 Consolidated statement of financial position

The CSFP will continue to consolidate 100% of the assets and liabilities of the parent

and subsidiary on a line by line basis.

Where there is also an associate in the group, there will be a line within noncurrent

assets representing the associate called 'Investment in associate'.

This is calculated as follows:

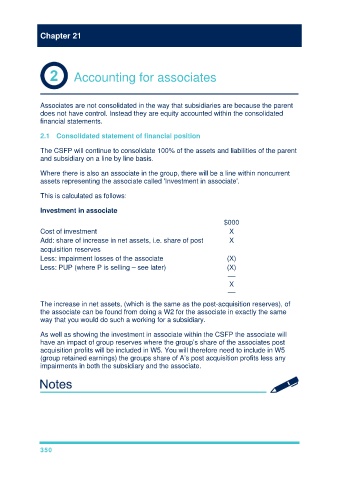

Investment in associate

$000

Cost of investment X

Add: share of increase in net assets, i.e. share of post X

acquisition reserves

Less: impairment losses of the associate (X)

Less: PUP (where P is selling – see later) (X)

––

X

––

The increase in net assets, (which is the same as the post-acquisition reserves), of

the associate can be found from doing a W2 for the associate in exactly the same

way that you would do such a working for a subsidiary.

As well as showing the investment in associate within the CSFP the associate will

have an impact of group reserves where the group’s share of the associates post

acquisition profits will be included in W5. You will therefore need to include in W5

(group retained earnings) the groups share of A’s post acquisition profits less any

impairments in both the subsidiary and the associate.

350