Page 39 - F1 Integrated Workbook STUDENT 2018

P. 39

Corporate Income Tax and Capital Tax Computations

Tax on trading income

You should now have a clear understanding of the fundamentals of tax on trading

income from the previous chapter.

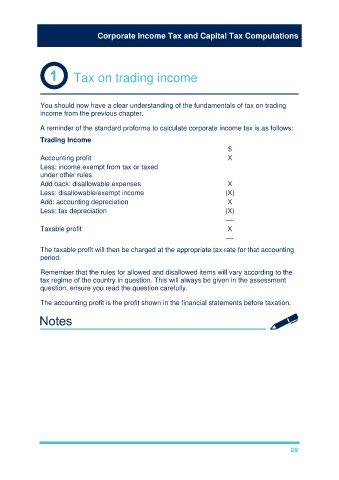

A reminder of the standard proforma to calculate corporate income tax is as follows:

Trading Income

$

Accounting profit X

Less: income exempt from tax or taxed

under other rules

Add back: disallowable expenses X

Less: disallowable/exempt income (X)

Add: accounting depreciation X

Less: tax depreciation (X)

––

Taxable profit X

––

The taxable profit will then be charged at the appropriate tax rate for that accounting

period.

Remember that the rules for allowed and disallowed items will vary according to the

tax regime of the country in question. This will always be given in the assessment

question, ensure you read the question carefully.

The accounting profit is the profit shown in the financial statements before taxation.

29