Page 402 - F1 Integrated Workbook STUDENT 2018

P. 402

Chapter 24

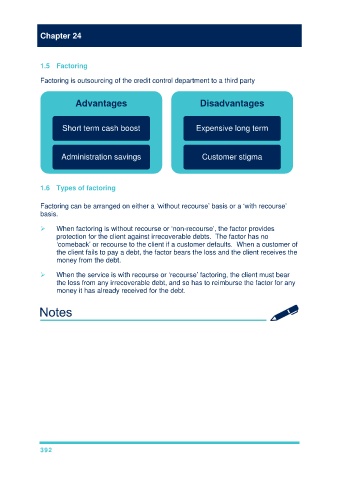

1.5 Factoring

Factoring is outsourcing of the credit control department to a third party

Advantages Disadvantages

Short term cash boost Expensive long term

Administration savings Customer stigma

1.6 Types of factoring

Factoring can be arranged on either a ‘without recourse’ basis or a ‘with recourse’

basis.

When factoring is without recourse or ‘non-recourse’, the factor provides

protection for the client against irrecoverable debts. The factor has no

‘comeback’ or recourse to the client if a customer defaults. When a customer of

the client fails to pay a debt, the factor bears the loss and the client receives the

money from the debt.

When the service is with recourse or ‘recourse’ factoring, the client must bear

the loss from any irrecoverable debt, and so has to reimburse the factor for any

money it has already received for the debt.

392