Page 426 - F1 Integrated Workbook STUDENT 2018

P. 426

Chaptter 25

Chaapter 33

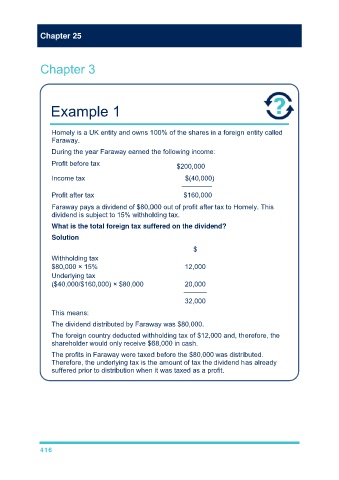

Exxampple 1

Hommely is a UUK entity and owns 100% of thee shares inn a foreign entity calleed

Farraway.

Durring the yeear Farawaay earned tthe followinng income::

Proofit before ttax $2200,000

Incoome tax $(40,000)

– ––––––––

Proofit after taxx $160,000

Farraway payss a dividennd of $80,0000 out of pprofit after tax to Hommely. This

diviidend is suubject to 155% withhollding tax.

Whhat is the ttotal foreiggn tax sufffered on tthe dividend?

Sollution

$

Witthholding taax

$800,000 × 15% 12,000

Undderlying tax

($440,000/$160,000) × $$80,000 20,000

––––––

32,000

This means:

Thee dividend distributedd by Farawway was $880,000.

Thee foreign country dedducted withhholding taax of $12,000 and, the erefore, the

shaareholder wwould only receive $668,000 in ccash.

Thee profits in Faraway wwere taxedd before the $80,000 was distribbuted.

Theerefore, thee underlyinng tax is thhe amount of tax the ddividend has alreadyy

sufffered priorr to distribuution when it was taxeed as a proofit.

416