Page 460 - F1 Integrated Workbook STUDENT 2018

P. 460

Chaptter 25

Chaapter 113

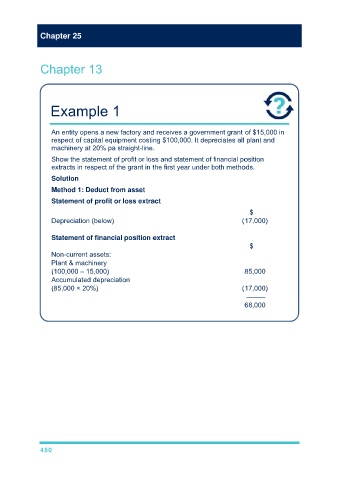

Exxampple 1

An entity opens a new ffactory andd receives a governmment grant oof $15,0000 in

respect of cappital equipmment costing $100,000. It depreciates all plant and

macchinery at 20% pa sttraight-line.

Shoow the stattement of pprofit or losss and stattement of ffinancial poosition

extrracts in resspect of thee grant in tthe first yeear under bboth methoods.

Sollution

Metthod 1: Deeduct fromm asset

Staatement off profit or loss extraact

$

Deppreciation (below) (17,000)

Staatement off financial position eextract

$

Nonn-current aassets:

Plant & machinery

(100,000 – 155,000) 8 85,000

Acccumulated depreciation

(85,000 × 20%%) (17,000)

–––––

6 68,000

450