Page 476 - F1 Integrated Workbook STUDENT 2018

P. 476

Chapter 25

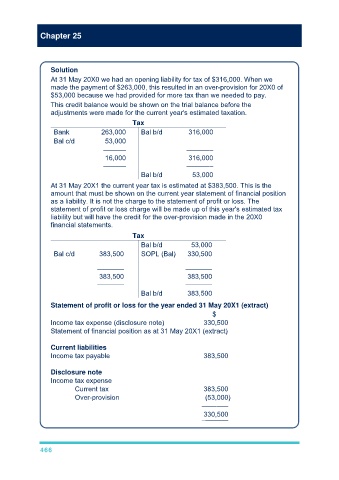

Solution

At 31 May 20X0 we had an opening liability for tax of $316,000. When we

made the payment of $263,000, this resulted in an over-provision for 20X0 of

$53,000 because we had provided for more tax than we needed to pay.

This credit balance would be shown on the trial balance before the

adjustments were made for the current year's estimated taxation.

Tax

Bank 263,000 Bal b/d 316,000

Bal c/d 53,000

–––––– –––––––

16,000 316,000

–––––– –––––––

Bal b/d 53,000

At 31 May 20X1 the current year tax is estimated at $383,500. This is the

amount that must be shown on the current year statement of financial position

as a liability. It is not the charge to the statement of profit or loss. The

statement of profit or loss charge will be made up of this year's estimated tax

liability but will have the credit for the over-provision made in the 20X0

financial statements.

Tax

Bal b/d 53,000

Bal c/d 383,500 SOPL (Bal) 330,500

––––––– –––––––

383,500 383,500

––––––– –––––––

Bal b/d 383,500

Statement of profit or loss for the year ended 31 May 20X1 (extract)

$

Income tax expense (disclosure note) 330,500

Statement of financial position as at 31 May 20X1 (extract)

Current liabilities

Income tax payable 383,500

Disclosure note

Income tax expense

Current tax 383,500

Over-provision (53,000)

–––––––

330,500

–––––––

466