Page 65 - F1 Integrated Workbook STUDENT 2018

P. 65

International Taxation

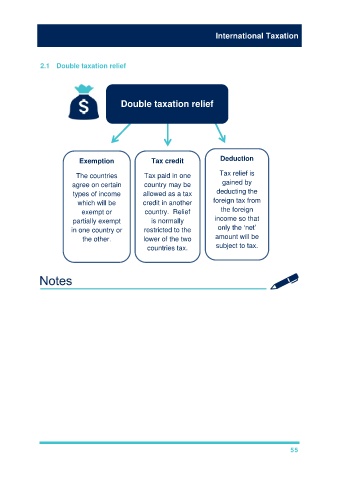

2.1 Double taxation relief

Double taxation relief

Deduction

Exemption Tax credit

The countries Tax paid in one Tax relief is

gained by

agree on certain country may be

types of income allowed as a tax deducting the

which will be credit in another foreign tax from

exempt or country. Relief the foreign

partially exempt is normally income so that

in one country or restricted to the only the ‘net’

amount will be

the other. lower of the two subject to tax.

countries tax.

55