Page 11 - P6 Slide Taxation - Lecture Day 5 - VAT Part 1

P. 11

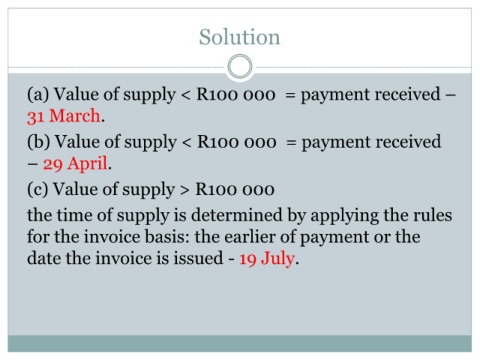

Solution

(a) Value of supply < R100 000 = payment received –

31 March.

(b) Value of supply < R100 000 = payment received

– 29 April.

(c) Value of supply > R100 000

the time of supply is determined by applying the rules

for the invoice basis: the earlier of payment or the

date the invoice is issued - 19 July.