Page 147 - P6 Slide Taxation - Lecture Day 5 - VAT Part 1

P. 147

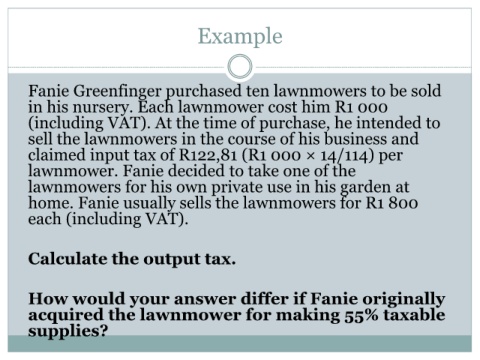

Example

Fanie Greenfinger purchased ten lawnmowers to be sold

in his nursery. Each lawnmower cost him R1 000

(including VAT). At the time of purchase, he intended to

sell the lawnmowers in the course of his business and

claimed input tax of R122,81 (R1 000 × 14/114) per

lawnmower. Fanie decided to take one of the

lawnmowers for his own private use in his garden at

home. Fanie usually sells the lawnmowers for R1 800

each (including VAT).

Calculate the output tax.

How would your answer differ if Fanie originally

acquired the lawnmower for making 55% taxable

supplies?