Page 44 - PowerPoint Presentation

P. 44

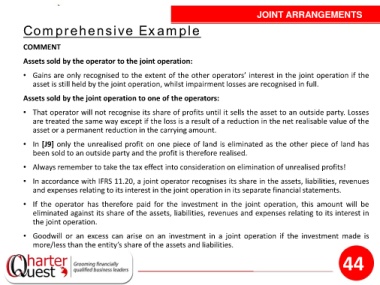

JOINT ARRANGEMENTS

Comprehensive Example

COMMENT

Assets sold by the operator to the joint operation:

• Gains are only recognised to the extent of the other operators’ interest in the joint operation if the

asset is still held by the joint operation, whilst impairment losses are recognised in full.

Assets sold by the joint operation to one of the operators:

• That operator will not recognise its share of profits until it sells the asset to an outside party. Losses

are treated the same way except if the loss is a result of a reduction in the net realisable value of the

asset or a permanent reduction in the carrying amount.

• In [J9] only the unrealised profit on one piece of land is eliminated as the other piece of land has

been sold to an outside party and the profit is therefore realised.

• Always remember to take the tax effect into consideration on elimination of unrealised profits!

• In accordance with IFRS 11.20, a joint operator recognises its share in the assets, liabilities, revenues

and expenses relating to its interest in the joint operation in its separate financial statements.

• If the operator has therefore paid for the investment in the joint operation, this amount will be

eliminated against its share of the assets, liabilities, revenues and expenses relating to its interest in

the joint operation.

• Goodwill or an excess can arise on an investment in a joint operation if the investment made is

more/less than the entity’s share of the assets and liabilities.

44