Page 24 - TAX4862/2 APPLIED TAXATION

P. 24

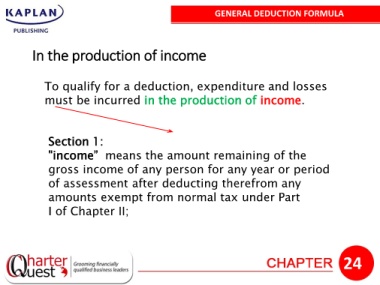

GENERAL DEDUCTION FORMULA

In the production of income

To qualify for a deduction, expenditure and losses

must be incurred in the production of income.

Section 1:

"income” means the amount remaining of the

gross income of any person for any year or period

of assessment after deducting therefrom any

amounts exempt from normal tax under Part

I of Chapter II;

24