Page 44 - TAX4862/2 APPLIED TAXATION

P. 44

GENERAL DEDUCTION FORMULA

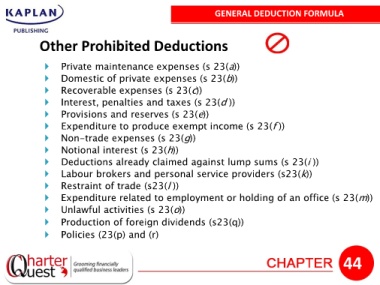

Other Prohibited Deductions

Private maintenance expenses (s 23(a))

Domestic of private expenses (s 23(b))

Recoverable expenses (s 23(c))

Interest, penalties and taxes (s 23(d ))

Provisions and reserves (s 23(e))

Expenditure to produce exempt income (s 23(f ))

Non-trade expenses (s 23(g))

Notional interest (s 23(h))

Deductions already claimed against lump sums (s 23(i ))

Labour brokers and personal service providers (s23(k))

Restraint of trade (s23(l ))

Expenditure related to employment or holding of an office (s 23(m))

Unlawful activities (s 23(o))

Production of foreign dividends (s23(q))

Policies (23(p) and (r)

44