Page 125 - Finac1 Test 1 slides

P. 125

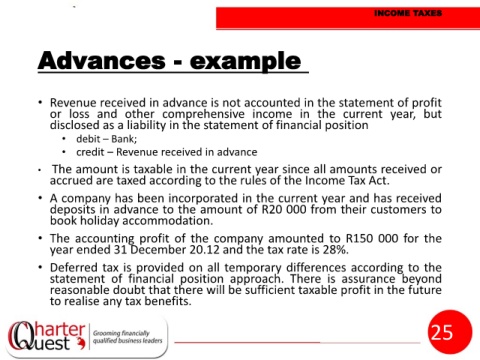

INCOME TAXES

Advances - example

• Revenue received in advance is not accounted in the statement of profit

or loss and other comprehensive income in the current year, but

disclosed as a liability in the statement of financial position

• debit – Bank;

• credit – Revenue received in advance

• The amount is taxable in the current year since all amounts received or

accrued are taxed according to the rules of the Income Tax Act.

• A company has been incorporated in the current year and has received

deposits in advance to the amount of R20 000 from their customers to

book holiday accommodation.

• The accounting profit of the company amounted to R150 000 for the

year ended 31 December 20.12 and the tax rate is 28%.

• Deferred tax is provided on all temporary differences according to the

statement of financial position approach. There is assurance beyond

reasonable doubt that there will be sufficient taxable profit in the future

to realise any tax benefits.

125