Page 140 - Finac1 Test 1 slides

P. 140

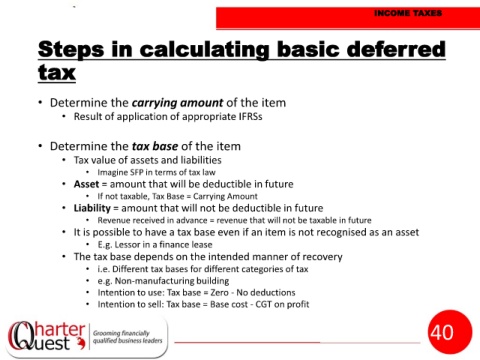

INCOME TAXES

Steps in calculating basic deferred

tax

• Determine the carrying amount of the item

• Result of application of appropriate IFRSs

• Determine the tax base of the item

• Tax value of assets and liabilities

• Imagine SFP in terms of tax law

• Asset = amount that will be deductible in future

• If not taxable, Tax Base = Carrying Amount

• Liability = amount that will not be deductible in future

• Revenue received in advance = revenue that will not be taxable in future

• It is possible to have a tax base even if an item is not recognised as an asset

• E.g. Lessor in a finance lease

• The tax base depends on the intended manner of recovery

• i.e. Different tax bases for different categories of tax

• e.g. Non-manufacturing building

• Intention to use: Tax base = Zero - No deductions

• Intention to sell: Tax base = Base cost - CGT on profit

140