Page 179 - Finac1 Test 1 slides

P. 179

IAS 8

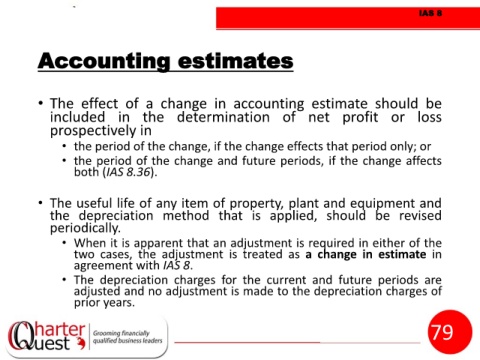

Accounting estimates

• The effect of a change in accounting estimate should be

included in the determination of net profit or loss

prospectively in

• the period of the change, if the change effects that period only; or

• the period of the change and future periods, if the change affects

both (IAS 8.36).

• The useful life of any item of property, plant and equipment and

the depreciation method that is applied, should be revised

periodically.

• When it is apparent that an adjustment is required in either of the

two cases, the adjustment is treated as a change in estimate in

agreement with IAS 8.

• The depreciation charges for the current and future periods are

adjusted and no adjustment is made to the depreciation charges of

prior years.

179