Page 9 - PowerPoint Presentation

P. 9

COST OF CAPITAL

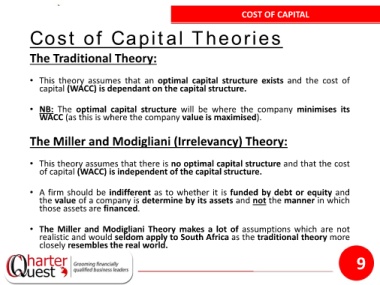

Cost of Capital Theories

The Traditional Theory:

• This theory assumes that an optimal capital structure exists and the cost of

capital (WACC) is dependant on the capital structure.

• NB: The optimal capital structure will be where the company minimises its

WACC (as this is where the company value is maximised).

The Miller and Modigliani (Irrelevancy) Theory:

• This theory assumes that there is no optimal capital structure and that the cost

of capital (WACC) is independent of the capital structure.

• A firm should be indifferent as to whether it is funded by debt or equity and

the value of a company is determine by its assets and not the manner in which

those assets are financed.

• The Miller and Modigliani Theory makes a lot of assumptions which are not

realistic and would seldom apply to South Africa as the traditional theory more

closely resembles the real world.

9