Page 34 - Taxation F6 - The South African Tax System

P. 34

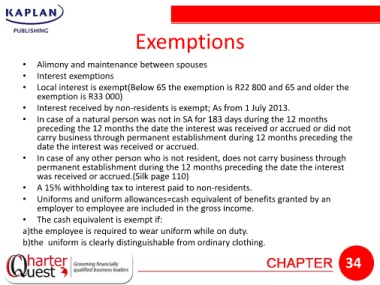

Exemptions

• Alimony and maintenance between spouses

• Interest exemptions

• Local interest is exempt(Below 65 the exemption is R22 800 and 65 and older the

exemption is R33 000)

• Interest received by non-residents is exempt; As from 1 July 2013.

• In case of a natural person was not in SA for 183 days during the 12 months

preceding the 12 months the date the interest was received or accrued or did not

carry business through permanent establishment during 12 months preceding the

date the interest was received or accrued.

• In case of any other person who is not resident, does not carry business through

permanent establishment during the 12 months preceding the date the interest

was received or accrued.(Silk page 110)

• A 15% withholding tax to interest paid to non-residents.

• Uniforms and uniform allowances=cash equivalent of benefits granted by an

employer to employee are included in the gross income.

• The cash equivalent is exempt if:

a)the employee is required to wear uniform while on duty.

b)the uniform is clearly distinguishable from ordinary clothing.

34