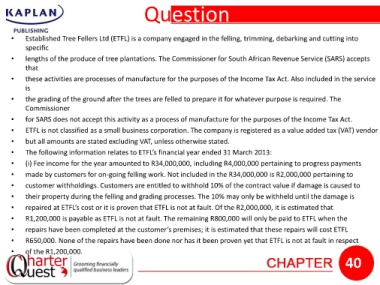

Page 40 - Taxation F6 - The South African Tax System

P. 40

Question 1

• Established Tree Fellers Ltd (ETFL) is a company engaged in the felling, trimming, debarking and cutting into

specific

• lengths of the produce of tree plantations. The Commissioner for South African Revenue Service (SARS) accepts

that

• these activities are processes of manufacture for the purposes of the Income Tax Act. Also included in the service

is

• the grading of the ground after the trees are felled to prepare it for whatever purpose is required. The

Commissioner

• for SARS does not accept this activity as a process of manufacture for the purposes of the Income Tax Act.

• ETFL is not classified as a small business corporation. The company is registered as a value added tax (VAT) vendor

• but all amounts are stated excluding VAT, unless otherwise stated.

• The following information relates to ETFL’s financial year ended 31 March 2013:

• (i) Fee income for the year amounted to R34,000,000, including R4,000,000 pertaining to progress payments

• made by customers for on-going felling work. Not included in the R34,000,000 is R2,000,000 pertaining to

• customer withholdings. Customers are entitled to withhold 10% of the contract value if damage is caused to

• their property during the felling and grading processes. The 10% may only be withheld until the damage is

• repaired at ETFL’s cost or it is proven that ETFL is not at fault. Of the R2,000,000, it is estimated that

• R1,200,000 is payable as ETFL is not at fault. The remaining R800,000 will only be paid to ETFL when the

• repairs have been completed at the customer’s premises; it is estimated that these repairs will cost ETFL

• R650,000. None of the repairs have been done nor has it been proven yet that ETFL is not at fault in respect

• of the R1,200,000.

40