Page 9 - F6 - Capital Gains Tax - Base Cost

P. 9

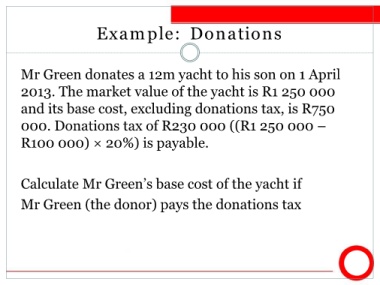

Example: Donations

Mr Green donates a 12m yacht to his son on 1 April

2013. The market value of the yacht is R1 250 000

and its base cost, excluding donations tax, is R750

000. Donations tax of R230 000 ((R1 250 000 –

R100 000) × 20%) is payable.

Calculate Mr Green’s base cost of the yacht if

Mr Green (the donor) pays the donations tax