Page 2 - F6 Slide - Taxation - Lecture Day 2

P. 2

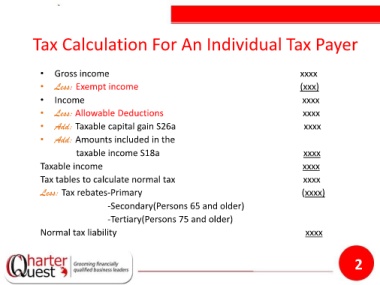

Tax Calculation For An Individual Tax Payer

• Gross income xxxx

• Less: Exempt income (xxx)

• Income xxxx

• Less: Allowable Deductions xxxx

• Add: Taxable capital gain S26a xxxx

• Add: Amounts included in the

taxable income S18a xxxx

Taxable income xxxx

Tax tables to calculate normal tax xxxx

Less: Tax rebates-Primary (xxxx)

-Secondary(Persons 65 and older)

-Tertiary(Persons 75 and older)

Normal tax liability xxxx

2