Page 25 - PowerPoint Presentation

P. 25

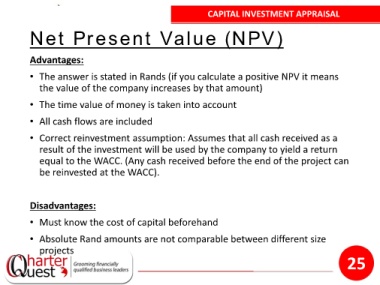

CAPITAL INVESTMENT APPRAISAL

Net Present Value (NPV)

Advantages:

• The answer is stated in Rands (if you calculate a positive NPV it means

the value of the company increases by that amount)

• The time value of money is taken into account

• All cash flows are included

• Correct reinvestment assumption: Assumes that all cash received as a

result of the investment will be used by the company to yield a return

equal to the WACC. (Any cash received before the end of the project can

be reinvested at the WACC).

Disadvantages:

• Must know the cost of capital beforehand

• Absolute Rand amounts are not comparable between different size

projects

25