Page 113 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 113

Non-current assets: Acquisition and depreciation

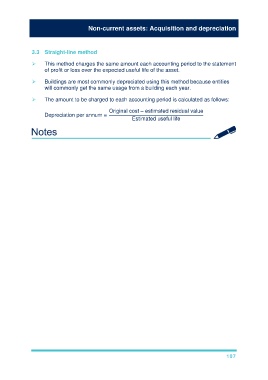

3.3 Straight-line method

This method charges the same amount each accounting period to the statement

of profit or loss over the expected useful life of the asset.

Buildings are most commonly depreciated using this method because entities

will commonly get the same usage from a building each year.

The amount to be charged to each accounting period is calculated as follows:

Original cost – estimated residual value

Depreciation per annum =

Estimated useful life

107