Page 207 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 207

Accounting for payroll

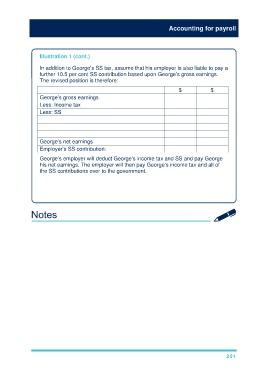

Illustration 1 (cont.)

In addition to George’s SS tax, assume that his employer is also liable to pay a

further 10.5 per cent SS contribution based upon George’s gross earnings.

The revised position is therefore:

$ $

George’s gross earnings 247.50

Less: Income tax 25% × ($247.50 – $75.00) 43.12

Less: SS (9% × $247.50) 22.27

———

(65.39)

———

George’s net earnings 182.11

Employer’s SS contribution: 10.5% × $247.50 25.98

George’s employer will deduct George’s income tax and SS and pay George

his net earnings. The employer will then pay George’s income tax and all of

the SS contributions over to the government.

Thus it can be seen that the total cost of employing George during for that

week amounted to $273.48 (the total of George’s gross earnings $247.50 plus

the employer’s SS contributions $25.98).

201