Page 217 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 217

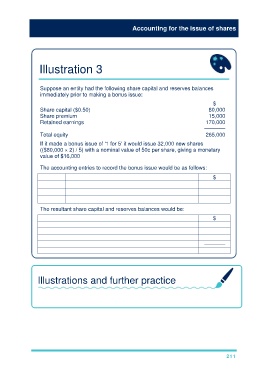

Accounting for the issue of shares

Illustration 3

Suppose an entity had the following share capital and reserves balances

immediately prior to making a bonus issue:

$

Share capital ($0.50) 80,000

Share premium 15,000

Retained earnings 170,000

–––––––

Total equity 265,000

If it made a bonus issue of '1 for 5' it would issue 32,000 new shares

(($80,000 × 2) / 5) with a nominal value of 50c per share, giving a monetary

value of $16,000

The accounting entries to record the bonus issue would be as follows:

$

Debit Share premium (use first as far as possible) 15,000

Credit Retained earnings (use if insufficient share premium) 1,000

Credit Share capital account (32,000 × 50c) 16,000

The resultant share capital and reserves balances would be:

$

Share capital ($0.50) 96,000

Share premium Nil

Retained earnings 169,000

–––––––

Total equity 265,000

Illustrations and further practice

211