Page 273 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 273

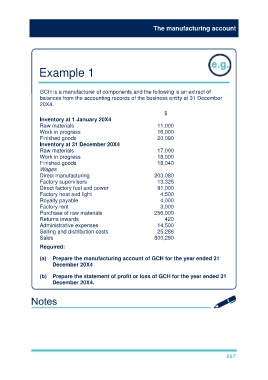

The manufacturing account

Example 1

GCH is a manufacturer of components and the following is an extract of

balances from the accounting records of the business entity at 31 December

20X4.

$

Inventory at 1 January 20X4

Raw materials 11,000

Work in progress 16,000

Finished goods 20,090

Inventory at 31 December 20X4

Raw materials 17,000

Work in progress 18,000

Finished goods 18,040

Wages

Direct manufacturing 203,080

Factory supervisors 13,325

Direct factory fuel and power 91,000

Factory heat and light 4,500

Royalty payable 4,000

Factory rent 3,000

Purchase of raw materials 256,000

Returns inwards 420

Administrative expenses 14,500

Selling and distribution costs 25,286

Sales 800,290

Required:

(a) Prepare the manufacturing account of GCH for the year ended 31

December 20X4

(b) Prepare the statement of profit or loss of GCH for the year ended 31

December 20X4.

267