Page 290 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 290

Chapter 17

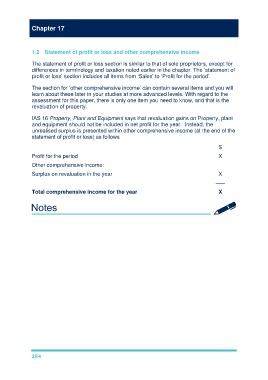

1.2 Statement of profit or loss and other comprehensive income

The statement of profit or loss section is similar to that of sole proprietors, except for

differences in terminology and taxation noted earlier in the chapter. The ‘statement of

profit or loss’ section includes all items from ‘Sales’ to ‘Profit for the period’.

The section for ‘other comprehensive income’ can contain several items and you will

learn about these later in your studies at more advanced levels. With regard to the

assessment for this paper, there is only one item you need to know, and that is the

revaluation of property.

IAS 16 Property, Plant and Equipment says that revaluation gains on Property, plant

and equipment should not be included in net profit for the year. Instead, the

unrealised surplus is presented within other comprehensive income (at the end of the

statement of profit or loss) as follows

$

Profit for the period X

Other comprehensive income:

Surplus on revaluation in the year X

–––

Total comprehensive income for the year X

284