Page 307 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 307

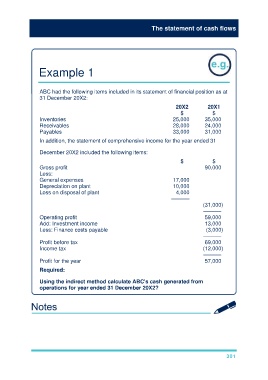

The statement of cash flows

Example 1

ABC had the following items included in its statement of financial position as at

31 December 20X2:

20X2 20X1

$ $

Inventories 25,000 35,000

Receivables 28,000 24,000

Payables 33,000 31,000

In addition, the statement of comprehensive income for the year ended 31

December 20X2 included the following items:

$ $

Gross profit 90,000

Less:

General expenses 17,000

Depreciation on plant 10,000

Loss on disposal of plant 4,000

––––––

(31,000)

––––––

Operating profit 59,000

Add: Investment income 13,000

Less: Finance costs payable (3,000)

––––––

Profit before tax 69,000

Income tax (12,000)

––––––

Profit for the year 57,000

Required:

Using the indirect method calculate ABC's cash generated from

operations for year ended 31 December 20X2?

301