Page 67 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 67

Ledger accounting and double-entry bookkeeping

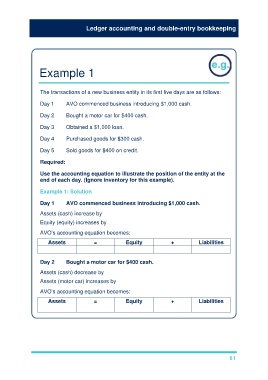

Example 1

The transactions of a new business entity in its first five days are as follows:

Day 1 AVO commenced business introducing $1,000 cash.

Day 2 Bought a motor car for $400 cash.

Day 3 Obtained a $1,000 loan.

Day 4 Purchased goods for $300 cash.

Day 5 Sold goods for $400 on credit.

Required:

Use the accounting equation to illustrate the position of the entity at the

end of each day. (Ignore inventory for this example).

Example 1: Solution

Day 1 AVO commenced business introducing $1,000 cash.

Assets (cash) increase by

Equity (equity) increases by

AVO’s accounting equation becomes:

Assets = Equity + Liabilities

Day 2 Bought a motor car for $400 cash.

Assets (cash) decrease by

Assets (motor car) increases by

AVO’s accounting equation becomes:

Assets = Equity + Liabilities

61