Page 73 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 73

Ledger accounting and double-entry bookkeeping

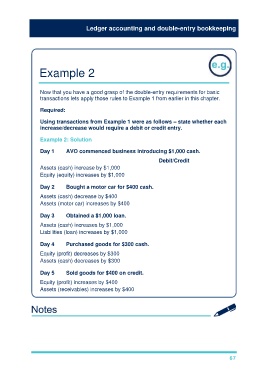

Example 2

Now that you have a good grasp of the double-entry requirements for basic

transactions lets apply those rules to Example 1 from earlier in this chapter.

Required:

Using transactions from Example 1 were as follows – state whether each

increase/decrease would require a debit or credit entry.

Example 2: Solution

Day 1 AVO commenced business introducing $1,000 cash.

Debit/Credit

Assets (cash) increase by $1,000

Equity (equity) increases by $1,000

Day 2 Bought a motor car for $400 cash.

Assets (cash) decrease by $400

Assets (motor car) increases by $400

Day 3 Obtained a $1,000 loan.

Assets (cash) increases by $1,000

Liabilities (loan) increases by $1,000

Day 4 Purchased goods for $300 cash.

Equity (profit) decreases by $300

Assets (cash) decreases by $300

Day 5 Sold goods for $400 on credit.

Equity (profit) increases by $400

Assets (receivables) increases by $400

67