Page 99 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 99

From trial balance to financial statements

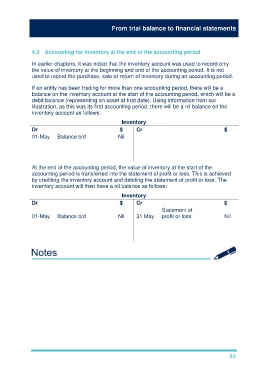

4.3 Accounting for inventory at the end of the accounting period

In earlier chapters, it was noted that the inventory account was used to record only

the value of inventory at the beginning and end of the accounting period. It is not

used to record the purchase, sale or return of inventory during an accounting period.

If an entity has been trading for more than one accounting period, there will be a

balance on the inventory account at the start of the accounting period, which will be a

debit balance (representing an asset at that date). Using information from our

illustration, as this was its first accounting period, there will be a nil balance on the

inventory account as follows:

Inventory

Dr $ Cr $

01-May Balance b/d Nil

At the end of the accounting period, the value of inventory at the start of the

accounting period is transferred into the statement of profit or loss. This is achieved

by crediting the inventory account and debiting the statement of profit or loss. The

inventory account will then have a nil balance as follows:

Inventory

Dr $ Cr $

Statement of

01-May Balance b/d Nil 31 May profit or loss Nil

93