Page 48 - Taxation F6

P. 48

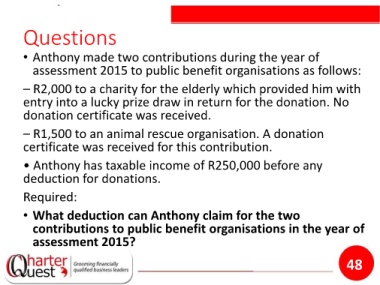

Questions

• Anthony made two contributions during the year of

assessment 2015 to public benefit organisations as follows:

– R2,000 to a charity for the elderly which provided him with

entry into a lucky prize draw in return for the donation. No

donation certificate was received.

– R1,500 to an animal rescue organisation. A donation

certificate was received for this contribution.

• Anthony has taxable income of R250,000 before any

deduction for donations.

Required:

• What deduction can Anthony claim for the two

contributions to public benefit organisations in the year of

assessment 2015?

48