Page 16 - Chapter 22 - Foreign Exchange (Cont.)

P. 16

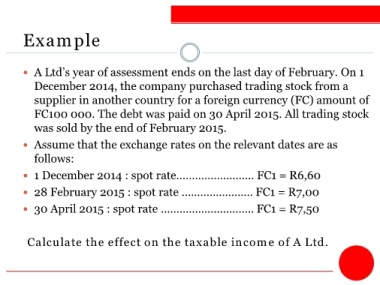

Example

16

A Ltd’s year of assessment ends on the last day of February. On 1

December 2014, the company purchased trading stock from a

supplier in another country for a foreign currency (FC) amount of

FC100 000. The debt was paid on 30 April 2015. All trading stock

was sold by the end of February 2015.

Assume that the exchange rates on the relevant dates are as

follows:

1 December 2014 : spot rate…………….......... FC1 = R6,60

28 February 2015 : spot rate ....................... FC1 = R7,00

30 April 2015 : spot rate .............................. FC1 = R7,50

Calculate the effect on the taxable income of A Ltd.