Page 23 - Chapter 22 - Foreign Exchange (Cont.)

P. 23

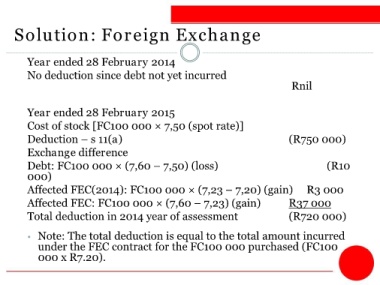

Solution: Foreign Exchange

Year ended 28 February 2014

No deduction since debt not yet incurred

Rnil

Year ended 28 February 2015

Cost of stock [FC100 000 × 7,50 (spot rate)]

Deduction – s 11(a) (R750 000)

Exchange difference

Debt: FC100 000 × (7,60 – 7,50) (loss) (R10

000)

Affected FEC(2014): FC100 000 × (7,23 – 7,20) (gain) R3 000

Affected FEC: FC100 000 × (7,60 – 7,23) (gain) R37 000

Total deduction in 2014 year of assessment (R720 000)

• Note: The total deduction is equal to the total amount incurred

under the FEC contract for the FC100 000 purchased (FC100

000 x R7.20).