Page 32 - Chapter 22 - Foreign Exchange (Cont.)

P. 32

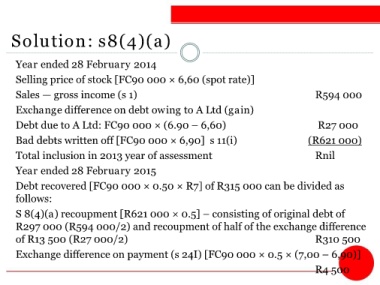

Solution: s8(4)(a)

Year ended 28 February 2014

Selling price of stock [FC90 000 × 6,60 (spot rate)]

Sales — gross income (s 1) R594 000

Exchange difference on debt owing to A Ltd (gain)

Debt due to A Ltd: FC90 000 × (6.90 – 6,60) R27 000

Bad debts written off [FC90 000 × 6,90] s 11(i) (R621 000)

Total inclusion in 2013 year of assessment Rnil

Year ended 28 February 2015

Debt recovered [FC90 000 × 0.50 × R7] of R315 000 can be divided as

follows:

S 8(4)(a) recoupment [R621 000 × 0.5] – consisting of original debt of

R297 000 (R594 000/2) and recoupment of half of the exchange difference

of R13 500 (R27 000/2) R310 500

Exchange difference on payment (s 24I) [FC90 000 × 0.5 × (7,00 – 6,90)]

R4 500