Page 12 - FINAL CFA I SLIDES JUNE 2019 DAY 5

P. 12

Session Unit 4:

14. Topics in Demand & Supply Analysis, p. 1

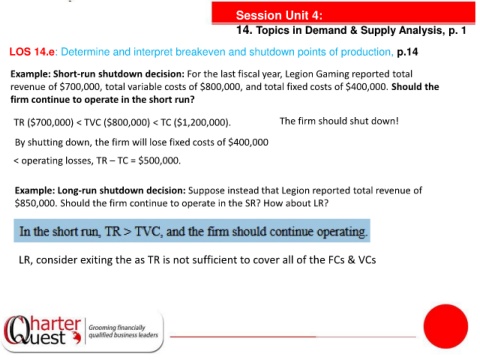

LOS 14.e: Determine and interpret breakeven and shutdown points of production, p.14

Example: Short-run shutdown decision: For the last fiscal year, Legion Gaming reported total

revenue of $700,000, total variable costs of $800,000, and total fixed costs of $400,000. Should the

firm continue to operate in the short run?

TR ($700,000) < TVC ($800,000) < TC ($1,200,000). The firm should shut down!

By shutting down, the firm will lose fixed costs of $400,000

< operating losses, TR – TC = $500,000.

Example: Long-run shutdown decision: Suppose instead that Legion reported total revenue of

$850,000. Should the firm continue to operate in the SR? How about LR?

LR, consider exiting the as TR is not sufficient to cover all of the FCs & VCs