Page 32 - Taxation P6 - Lecture day 2 Notes - Trust

P. 32

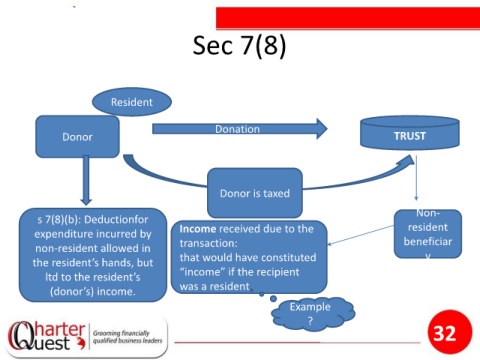

Sec 7(8)

Resident

Donation

Donor TRUST

Donor is taxed

Non-

s 7(8)(b): Deductionfor

expenditure incurred by Income received due to the resident

transaction: beneficiar

non-resident allowed in

the resident’s hands, but that would have constituted y

“income” if the recipient

ltd to the resident’s

was a resident

(donor’s) income.

Example

?

32