Page 3 - Chapter 32 - VAT Part 1

P. 3

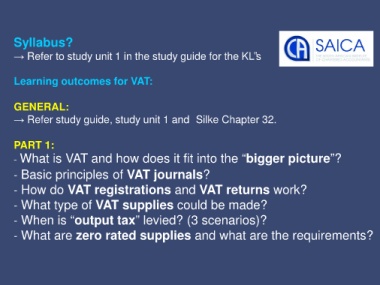

Syllabus?

→ Refer to study unit 1 in the study guide for the KL‟s

Learning outcomes for VAT:

GENERAL:

→ Refer study guide, study unit 1 and Silke Chapter 32.

PART 1:

- What is VAT and how does it fit into the “bigger picture”?

- Basic principles of VAT journals?

- How do VAT registrations and VAT returns work?

- What type of VAT supplies could be made?

- When is “output tax” levied? (3 scenarios)?

- What are zero rated supplies and what are the requirements?