Page 43 - Chapter 32 - VAT Part 1

P. 43

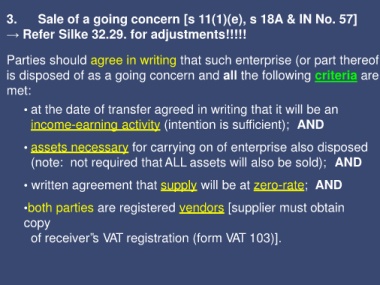

3. Sale of a going concern [s 11(1)(e), s 18A & IN No. 57]

→ Refer Silke 32.29. for adjustments!!!!!

Parties should agree in writing that such enterprise (or part thereof

is disposed of as a going concern and all the following criteria are

met:

• at the date of transfer agreed in writing that it will be an

income-earning activity (intention is sufficient); AND

• assets necessary for carrying on of enterprise also disposed

(note: not required that ALL assets will also be sold); AND

• written agreement that supply will be at zero-rate; AND

•both parties are registered vendors [supplier must obtain

copy

of receiver‟s VAT registration (form VAT 103)].