Page 3 - F6 - Capital Gains Tax - Part 1

P. 3

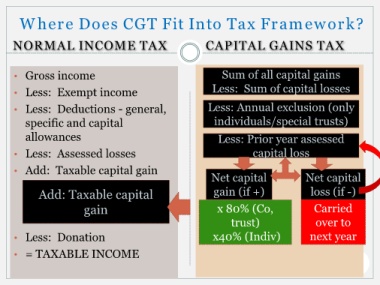

Where Does CGT Fit Into Tax Framework?

NORMAL INCOME TAX CAPITAL GAINS TAX

• Gross income Sum of all capital gains

• Less: Exempt income Less: Sum of capital losses

• Less: Deductions - general, Less: Annual exclusion (only

specific and capital individuals/special trusts)

allowances Less: Prior year assessed

• Less: Assessed losses capital loss

• Add: Taxable capital gain

Net capital Net capital

Add: Taxable capital gain (if +) loss (if -)

gain x 80% (Co, Carried

trust) over to

• Less: Donation x40% (Indiv) next year

• = TAXABLE INCOME