Page 19 - MCOM 2016 CASE STUDY 1

P. 19

P a g e | 18

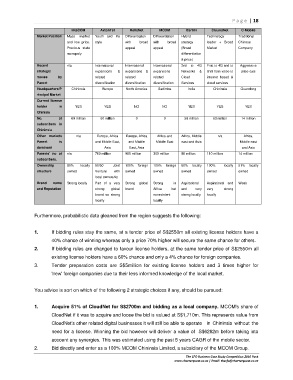

IntaCOM AxtonTet HelloNet MCOM Bartini CloundNet C-Mobile

Market Position Mass market Youth and life Differentiation Differentiation Hybrid Technology Traditional

and low price. style with broad with broad strategy leader + Broad Chinese

Previous state appeal appeal (Broad Market Company

monopoly differentiation

& price)

Recent n/a International International International 2nd to 4G First to 4G and to Aggressive

strategic expansions & expansions & expansions Networks & shift from voice to price cuts

moves by related related related Cloud internet based &

Parent diversification diversification diversification Services cloud services

Headquarters/P Chininsia Europe North America Sadimba India Chininsia Guandong

rincipal Market

Current license

holder in YES YES NO NO YES YES YES

Chinisia

No. of 69 million 60 million 0 0 58 million 63 million 14 million

subscribers in

Chininsia

Other markets n/a Europe, Africa Europe, Africa Africa and Africa, Middle n/a Africa,

Parent is and Middle East, and Middle Middle East east and Asia Middle east

dominant Asia East, Asia and Asia

Parents' no of n/a 760 million 960 million 300 million 88 million 110 million 14 million

subscribers.

Ownership 90% locally 50/50 Joint 100% foreign 100% foreign 60% locally 100% locally 51% locally

structure owned Venture with owned owned owned owned owned

local ownership

Brand name Strong locally Part of a very Strong global Strong in Aspirational Aspirational and Weak

and Reputation strong global brand Africa but and very very strong

brand so strong nonexistent strong locally locally

locally locally

Furthermore, probabilistic data gleaned from the region suggests the following:

1. If bidding rules stay the same, at a tender price of S$2550m all existing license holders have a

40% chance of winning whereas only a price 70% higher will secure the same chance for others.

2. If bidding rules are changed to favour license holders, at the same tender price of S$2550m all

existing license holders have a 60% chance and only a 4% chance for foreign companies.

3. Tender preparation costs are S$5million for existing license holders and 3 times higher for

'new' foreign companies due to their less informed knowledge of the local market.

You advice is sort on which of the following 2 strategic choices if any, should be pursued:

1. Acquire 51% of CloudNet for S$2700m and bidding as a local company. MCOM's share of

CloudNet if it was to acquire and loose the bid is valued at S$1,710m. This represents value from

CloudNet's other related digital businesses it will still be able to operate in Chininsia without the

need for a license. Winning the bid however will deliver a value of S$6262m before taking into

account any synergies. This was estimated using the past 5 years CAGR of the mobile sector.

2. Bid directly and enter as a 100% MCOM Chininsia Limited, a subsidiary of the MCOM Group.

The CFO Business Case Study Competition 2016 Pack

www.charterquest.co.za | Email: thecfo@charterquest.co.za