Page 120 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 120

Chapter 10

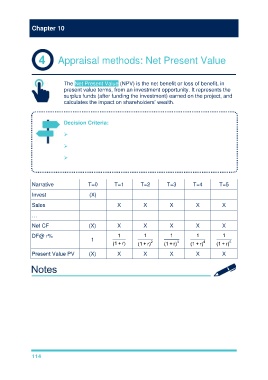

Appraisal methods: Net Present Value

The Net Present Value (NPV) is the net benefit or loss of benefit, in

present value terms, from an investment opportunity. It represents the

surplus funds (after funding the investment) earned on the project, and

calculates the impact on shareholders’ wealth.

Decision Criteria:

A project with a positive NPV is viable.

A project with a negative NPV is not viable.

Faced with mutually-exclusive projects, choose the project with the

highest NPV.

Narrative T=0 T=1 T=2 T=3 T=4 T=5

Invest (X)

Sales X X X X X

…

Net CF (X) X X X X X

DF@ r% 1 1 1 1 1

1 3 5

(1 + r) (1 + r) 2 (1 + r) (1 + r) 4 (1 + r)

Present Value PV (X) X X X X X

114