Page 13 - Things to Consider When Buying a Home - Fall 2018 - Saro Dedeyan

P. 13

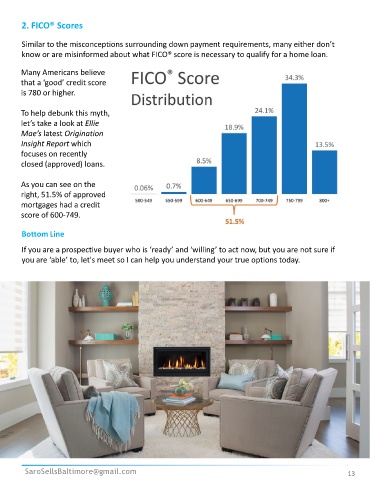

2. FICO® Scores

Similar to the misconceptions surrounding down payment requirements, many either don’t

know or are misinformed about what FICO® score is necessary to qualify for a home loan.

Many Americans believe

that a ‘good’ credit score

is 780 or higher. UP

To help debunk this myth, D

let’s take a look at Ellie A

Mae’s latest Origination TE

Insight Report which

focuses on recently

closed (approved) loans.

As you can see on the

right, 51.5% of approved

mortgages had a credit

score of 600-749.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but you are not sure if

you are ‘able’ to, let's meet so I can help you understand your true options today.

SaroSellsBaltimore@gmail.com 13