Page 182 - BOXFORD

P. 182

was significantly impacted by a new subdivision. This year’s growth is made up of a combination

of new construction, additions, and miscellaneous building improvements.

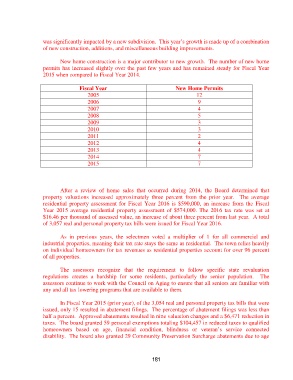

New home construction is a major contributor to new growth. The number of new home

permits has increased slightly over the past few years and has remained steady for Fiscal Year

2015 when compared to Fiscal Year 2014.

Fiscal Year New Home Permits

2005 12

2006 9

2007 4

2008 5

2009 3

2010 3

2011 2

2012 4

2013 4

2014 7

2015 7

After a review of home sales that occurred during 2014, the Board determined that

property valuations increased approximately three percent from the prior year. The average

residential property assessment for Fiscal Year 2016 is $590,000, an increase from the Fiscal

Year 2015 average residential property assessment of $574,000. The 2016 tax rate was set at

$16.46 per thousand of assessed value, an increase of about three percent from last year. A total

of 3,057 real and personal property tax bills were issued for Fiscal Year 2016.

As in previous years, the selectmen voted a multiplier of 1 for all commercial and

industrial properties, meaning their tax rate stays the same as residential. The town relies heavily

on individual homeowners for tax revenues as residential properties account for over 96 percent

of all properties.

The assessors recognize that the requirement to follow specific state revaluation

regulations creates a hardship for some residents, particularly the senior population. The

assessors continue to work with the Council on Aging to ensure that all seniors are familiar with

any and all tax lowering programs that are available to them.

In Fiscal Year 2015 (prior year), of the 3,054 real and personal property tax bills that were

issued, only 15 resulted in abatement filings. The percentage of abatement filings was less than

half a percent. Approved abatements resulted in nine valuation changes and a $6,471 reduction in

taxes. The board granted 59 personal exemptions totaling $104,457 in reduced taxes to qualified

homeowners based on age, financial condition, blindness or veteran’s service connected

disability. The board also granted 29 Community Preservation Surcharge abatements due to age

181