Page 221 - Mercy MOR All Regions_FinalwVideo

P. 221

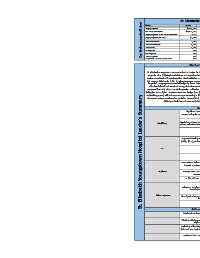

Key Performance Indicators Metric St. Elizabeth Youngstown Hospital % Variance -2.0% $29,056,687

Prior

Budget

Variance

Actual

($418)

0.0%

$7,443,118

$7,621,376

$7,443,536

Supply Expense

Net Patient Revenue

($595,380)

$30,267,450

$29,672,070

25.1%

24.6%

26.2%

Supply Expense % Net Patient Revenue

2.0%

0.5%

Supply Expense per EIPA

$2,418

$2,523

($25)

-1.0%

$2,393

1,626

1,625

11

1,636

0.7%

Total Admissions

Total Patient Days

8,032

8,243

8,564

6.6%

532

(32)

-1.0%

3,110

Total EIPAs

3,078

3,021

IP Surgeries

6.7%

284

313

334

OP Surgeries

574

Total Surgeries

549

603

-9.0%

140

3.6%

169

Outpatient Cath Lab Procedures 215 290 (75) (54) 21 6 -25.9% 290

175

Site Performance Summary

St. Elizabeth Youngstown's expense arrived at budget for the month at $418 under budget (0% variance). Net revenue fell short of

target by 595K (2%) despite admissions and surgeries that closely tracked with budgeted expectations. The primary driver of this

variance was Medical Surgical supplies, Blood and Other Non Medical expense. O/P registrations came in 7.9% under budget while

O/P revenue fell short by 3.9%. Supply expense per EIPA arrived right at budget, indicating overall approriate use of supplies during

the period. Drug expense exceeded budget by $124K driven by increased antineoplastic and thrombolytic purchases. Despite the

O/P shortfall Cath Lab remained strong with volumes exceeding budget by 3% and prior-year by 28%. Stent expense and CRM

compared favorably with PY on similar product utilization. Surgical volume exceeded budget on strong outpatient volume with I/P

falling just short of plan. Implants were over budget $24K (1.3%) on the increased volume, while the facility was able to hold the line

on MedSurg spend, with this expense expense coming in $82K (3.4%) under budget. TAVR volume (7 procedures, $228K) was in-line

St. Elizabeth Youngstown Hospital Leader's Summary

with recent volume trends and exceeded PY by two ($65K). Implant Other exceeded budget by $53K, mainly driven by CardioMEMS

($39K) and Occluder PFO expense ($20K) as well as three EVAR/AAA procedures totaling $62K.

Key Challenges

Significant increase in Intuitive Surgical expense compared to PY ($69K vs. $36K).

Corresponding decrease in expense expected over next 2-3 months as instrument have 10-20

uses before requiring replacement.

Special Procedures up $87K on several high-dollar treatments/devices including $48K Sirtex SIR-

Med/Surg

sphere radiation therapy (consider coding elsewhere) as well as 11 ea. ($31K) in EKOS catheters

Drugs experiencing an increase in utilization include the folloing: Herceptin (antineoplastic, up

$206K, $0 PY), Activase (thrombolytic, up $99K, 642%), and Neulasta (hematopoetic, up $11K,

12%)

Rx

TAVR volume in-line with budgeted expectations, no Intuity valves installed vs. 3 ea. PY ($36K

impact). ICD/pacers exceeded budget by 18K on similar volume to PY. Two SICDs were

implanted at a total cost of $52K

Implants Average stent cost decreased $144 ea. vs. PY on improved compliance with the Ministry's

contract strategy. Abbott vs. Boston Sci market share is 82%/17%

A $31,500 AAA case was performed - case included a rare hypogastric component.

Reimbursement for this procedure is under review.

Laboratoy supplies exceeded budget by $75K on flu-related volume increase, Austintown ED

came in $24K oover budget, Microbiology $28K over, Chemistry $18K over).

Other Expenses

Out of period expense of $25K for Linde bulk O2 invoices. SEYH Respiratory Director retired in

late 2017, some invoices in the transition not processed.

Actions Taken/Planned:

Medtronic DES evaluation is planned for 2/1 - 2/14. Physicians are engaged and actively

participating.

Working with Strategic Sourcing team on impacting price of the approved clinical trial of the

Vigilant X4 device. Cases held pending Ministry-approve pricing.

Reviewing utilization/inventory levels for daVinci disposables as well as account coding: 2018:

$29K Endomechanical, $28K Instruments, $12. K Med Surg 2017:

$36K, all to Med Surg

Reviewed Red Cross blood handling process after extreme spikes/credits in expense were

encoutered throughout MHY in Q4, 2017.